Blockchain technology is a digitally distributed, decentralized, public ledger that exists across a network. It securely stores records in a transparent, immutable, and tamper-resistant manner. Each "block" contains data, and these blocks are linked in a chronological "chain." Blockchain is particularly noteworthy for its use with cryptocurrencies and NFTs. Additionally, blockchain wallets and smart contracts play crucial roles in this technology, enhancing security and automating transactions.

A blockchain is a distributed database or ledger shared across a computer network's nodes. It is best known for its crucial role in cryptocurrency systems, maintaining a secure and decentralized record of transactions, but it is not limited to cryptocurrency uses. Blockchain technology can be used to make data in any industry immutable—meaning it cannot be altered.

Since a block cannot be changed, the only trust needed is at the point where a user or programme enters data. This reduces the need for trusted third parties, such as auditors or other humans, who add costs and can make mistakes.

Since Bitcoin's introduction in 2009, blockchain uses have exploded via the creation of various cryptocurrencies, decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and smart contracts. Blockchain wallets also play a significant role in this ecosystem, enhancing security and facilitating transactions.

How Does a Blockchain Work?

You might be familiar with spreadsheets or databases. A blockchain is somewhat similar because it is a database where information is entered and stored. The key difference between a traditional database or spreadsheet and a blockchain is how the data is structured and accessed.

A blockchain consists of programmes called scripts that conduct the tasks you usually would in a database: entering and accessing information, and saving and storing it somewhere. A blockchain is distributed, which means multiple copies are saved on many machines, and they must all match for it to be valid.

The Bitcoin blockchain collects transaction information and enters it into a 4MB file called a block (different blockchains have different size blocks). Once the block is full, the block data is run through a cryptographic hash function, which creates a hexadecimal number called the block header hash.

The hash is then entered into the following block header and encrypted with the other information in that block's header, creating a chain of blocks, hence the name “blockchain.”

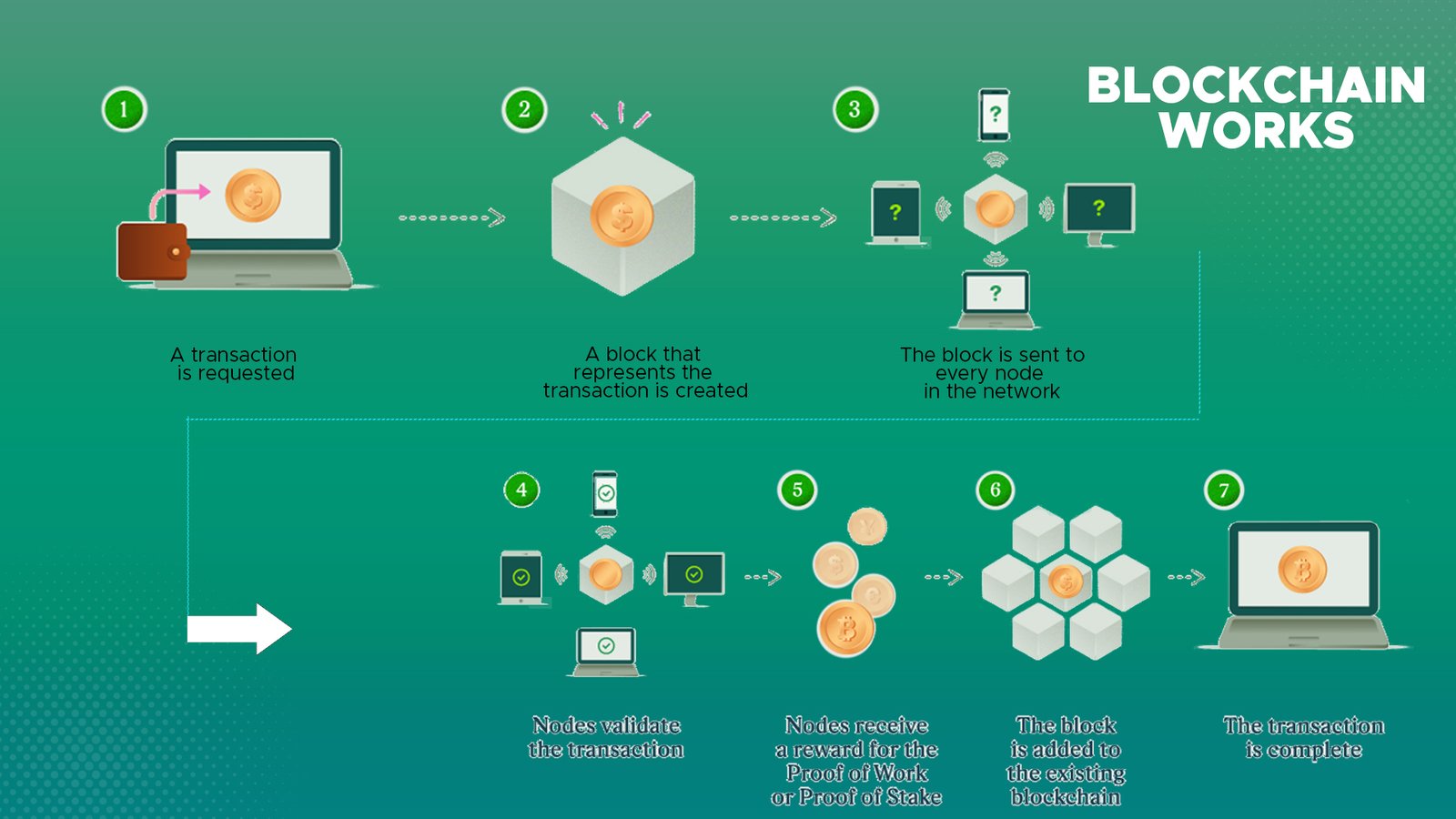

Transaction Process :

Transactions follow a specific process, depending on the blockchain. For example, on Bitcoin's blockchain, if you initiate a transaction using your cryptocurrency wallet—the application that provides an interface for the blockchain—it starts a sequence of events.

In Bitcoin, your transaction is sent to a memory pool, where it is stored and queued until a miner picks it up. Once it is entered into a block and the block fills up with transactions, it is closed, and the mining begins.

Every node in the network proposes its own blocks in this manner because each node selects different transactions. Each node works on its own blocks, aiming to meet the difficulty target by adjusting the "nonce"—a value used only once.

The nonce is a modifiable field in the block header that increments with each mining attempt. If the resulting hash does not meet or fall below the target hash, the nonce is increased by one, generating a new hash, and so forth. This process rolls over roughly every 4.5 billion attempts (taking less than a second), which then triggers the use of an additional counter called the "extra nonce." This continues until a miner produces a valid hash, effectively winning the race and receiving a reward.

This process of generating hashes until a valid one is found is the “proof-of-work” often discussed—it demonstrates the miner’s computational effort. The substantial work required to validate each hash is the reason the Bitcoin network consumes significant computational power and energy.

Once a block is completed, a transaction is processed. However, the block is not considered fully confirmed until five additional blocks have been validated. This confirmation typically takes about one hour, as the network averages around 10 minutes per block (the initial block containing the transaction and five following blocks, each at 10 minutes, adds up to 60 minutes).

Not all blockchains follow this model. For instance, Ethereum’s network randomly selects one validator from all users who have staked Ether to validate blocks, which the network then confirms. This method is considerably faster and uses far less energy than Bitcoin’s process.

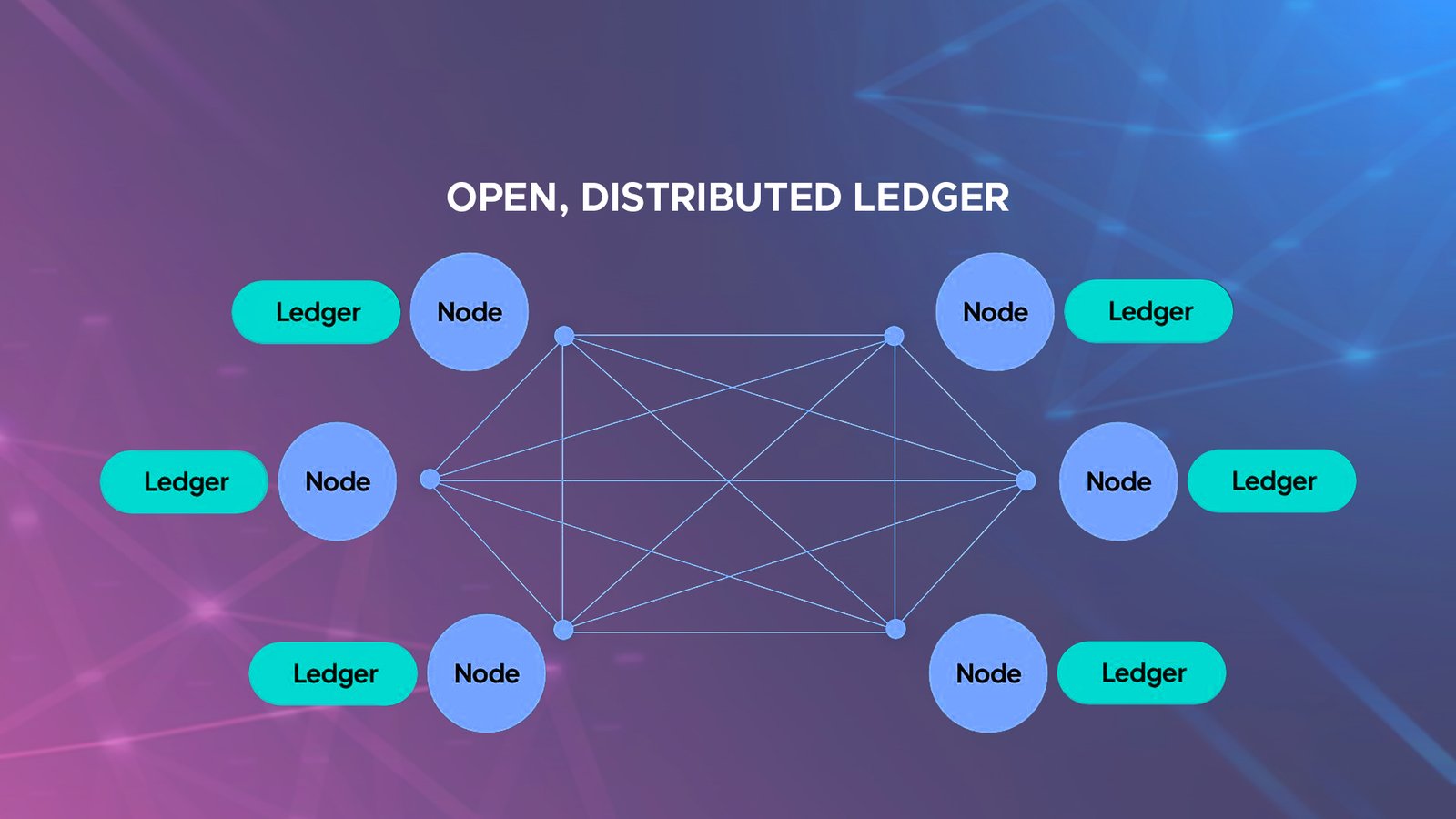

Blockchain Decentralization :

Blockchain technology allows data within a database to be distributed across multiple network nodes computers or devices running blockchain software—in various locations. This distribution creates redundancy and preserves the data’s integrity. For example, if someone tries to alter a record on one node, other nodes prevent it by cross-verifying block hashes. In this way, no single node can modify information within the chain.

Due to this distributed nature—and the cryptographic proof of work— blockchain data, such as transaction history, becomes irreversible. While a public blockchain typically holds records of transactions, private blockchains may store other information, such as legal contracts, state identifications, or a company’s inventory. Most blockchains do not “store” these items directly; they usually run them through a hashing algorithm and represent them on the blockchain with a token.

Blockchain Transparency

Owing to the decentralized structure of the Bitcoin blockchain, all transactions are transparently viewable either by downloading and reviewing them or through blockchain explorers that allow anyone to see transactions in real time. Each node keeps an updated copy of the chain as new blocks are confirmed and added. This setup enables the tracking of a bitcoin wherever it goes.

In cases of past exchange hacks resulting in lost cryptocurrency, even if the hackers remained anonymous (except for their wallet addresses), the cryptocurrency could still be traced since wallet addresses are recorded on the blockchain.

Although the records stored in Bitcoin’s blockchain (and most others) are encrypted, only the address owner can reveal their identity, preserving user anonymity while maintaining transparency.

Is Blockchain Secure?

Blockchain technology achieves decentralized security and trust in multiple ways. New blocks are always stored sequentially and chronologically added to the “end” of the blockchain. Once a block is added, previous blocks cannot be altered.

Any change in data affects the hash of the block it belongs to, and since each block contains the hash of the previous block, altering one block affects subsequent blocks. The network would typically reject any altered block due to hash mismatches. However, smaller blockchain networks may be vulnerable to alterations.

While blockchains are often viewed as secure, they are distributed ledgers whose security level depends on their code. If there are vulnerabilities in the code, they can be exploited.

In smaller chains, attackers could potentially succeed if they control over half of the network’s computational power (a "51% attack"). On larger blockchains, like Bitcoin, this is virtually impossible. The network operates so quickly that it would likely move beyond the blocks an attacker might try to alter. As of September 2024, the Bitcoin network hashes at a rate of around 640 exahashes per second (18 zeros).

Likewise, the Ethereum blockchain is difficult to hack, as attackers would need control over half of the staked ether. As of September 2024, over 33.8 million ETH is staked by more than a million validators. Attackers would need ownership of over 17 million ETH and be selected to validate blocks enough times to have their blocks included in the chain.

Bitcoin vs. Blockchain :

Blockchain technology was initially conceptualized in 1991 by Stuart Haber and W. Scott Stornetta, who aimed to establish a system where document timestamps could not be tampered with. However, it wasn’t until nearly two decades later, with the launch of Bitcoin in January 2009, that blockchain had its first real-world application.

Bitcoin:

The Bitcoin protocol is based on blockchain. In a paper introducing the digital currency, Bitcoin’s pseudonymous creator, Satoshi Nakamoto, described it as “a new electronic cash system that’s fully peer-to-peer, with no trusted third party.”

Essentially, Bitcoin uses blockchain as a means to transparently record a ledger of payments or other transactions between parties.

Blockchain :

Blockchain technology can immutably record various types of data. These data points could include transactions, election votes, product inventories, state identifications, property deeds, and more.

Currently, tens of thousands of projects aim to implement blockchains in ways beyond recording transactions, such as using them as secure voting systems in democratic elections. Due to blockchain’s immutable nature, fraudulent voting would be significantly more challenging. For instance, in a hypothetical voting system, each citizen could be issued a single token or cryptocurrency. Each candidate could be assigned a unique wallet address, and voters could send their token to the candidate’s address of their choice. Blockchain’s transparency and traceability would remove the need for human vote counting and reduce the risk of ballot tampering.

Blockchain vs. Banks

Blockchain technology is considered a disruptive force in finance, especially in payments and banking. However, there are considerable differences between banks and decentralized blockchains.

To illustrate, comparing the banking system to Bitcoin’s blockchain implementation highlights these differences.

How Are Blockchains Used?

As we now understand, blocks on Bitcoin’s blockchain store transactional data, yet blockchain technology has since evolved far beyond cryptocurrency. Today, thousands of other digital assets and applications utilize blockchain to securely store different types of data. Many companies—including Walmart, Pfizer, AIG, Siemens, and Unilever—are experimenting with blockchain for varied purposes. For example, IBM’s Food Trust blockchain tracks the journey of food products to their destinations.

Why is this useful?

The food industry has experienced numerous outbreaks of harmful pathogens like E. coli, salmonella, and listeria; sometimes, contaminants are accidentally introduced to foods. In the past, identifying the source of such outbreaks could take weeks, delaying critical safety measures. With blockchain, food products’ entire routes can be tracked from origin through each stage to final delivery. This transparency means brands can pinpoint contamination sources much faster, potentially saving lives. This is just one practical example of blockchain in use, with many more applications emerging across industries.

Banking and Finance:

Perhaps no sector stands to gain as much from blockchain technology as personal banking. Banks typically operate only during business hours, five days per week. This means if you deposit a cheque after hours, you may wait until the next business day for processing. Even during business hours, verification can take one to three days due to high transaction volumes.

By integrating blockchain into banking, consumers could see transactions completed within minutes or seconds—the time it takes to add a block to the blockchain. Blockchain technology never "closes," offering a seamless experience regardless of time or holidays. Additionally, blockchain offers banks a way to transfer funds more securely and quickly between institutions, reducing risks and costs associated with holding large amounts of money in transit. In financial trading, blockchain could drastically reduce settlement times from several days to mere moments.

Currency:

Blockchain is the foundation for digital currencies like Bitcoin, allowing for easy international transactions without the limitations of traditional banking systems. By using blockchain wallets, users bypass currency exchange limitations, local banking infrastructure, and economic instability to transact directly with anyone connected to the blockchain network.

Healthcare:

Blockchain can securely store medical records, helping healthcare providers protect sensitive patient information. When a medical record is created and signed, it can be stored on the blockchain, providing proof that it has not been altered. Personal health records on the blockchain could be encrypted and accessed only by authorized individuals, ensuring both security and privacy.

Property Records:

Anyone who has spent time in a local recording office knows the challenges of registering property rights—it is inefficient and labor-intensive. Currently, a physical deed must be delivered to a public employee who manually enters it into a central database. In property disputes, claims must be reconciled with public records, which can be prone to human error.

Blockchain technology offers a solution. If property ownership records were stored and verified on a blockchain, property deeds would be accurate, up-to-date, and easily accessible. For people in war-torn or infrastructure-limited areas, blockchain could establish clear records of property ownership, creating transparency and security even in challenging environments.

Smart Contracts:

A smart contract is a type of computer code embedded within the blockchain to facilitate transactions. These contracts automatically execute transactions when pre-set conditions are met, without requiring a third party. This automation could revolutionize how agreements are managed and executed, reducing costs and improving efficiency.

Supply Chains:

Just as IBM’s Food Trust demonstrates, blockchain technology enables suppliers to trace the origins of the materials they purchase. Companies can use blockchain to verify the authenticity of claims like “Organic,” “Fair Trade,” or “Local,” helping build trust and transparency in the supply chain.

Voting:

Blockchain technology could modernize voting systems by preventing election fraud and encouraging higher voter turnout. During the November 2018 midterm elections in West Virginia, blockchain voting was tested to provide greater security and transparency. By using blockchain, votes could be made nearly impossible to tamper with, creating an accessible, transparent electoral process with instant results and reduced need for recounts.

Advantages and Disadvantages of Blockchain:

Despite its complexity, blockchain technology holds immense potential for decentralized record-keeping, enhancing user privacy, increasing security, and reducing costs. However, blockchain also comes with challenges, such as scalability, energy consumption, and regulatory concerns.

Benefits of Blockchains

Accuracy of the Chain

In a blockchain network, transactions are verified by thousands of computers and devices. This removes human involvement from the verification process, reducing human error and ensuring a highly accurate record of information. If an error occurs on one device, it’s detected by the rest of the network, ensuring that any computational mistake isn’t accepted by the other copies of the blockchain.

Cost Reductions

In traditional transactions, consumers often rely on banks to verify transactions or notaries to sign documents. Blockchain technology removes the need for third-party verification, along with the associated costs. For example, business owners incur fees when accepting credit card payments due to processing companies. Blockchain systems, such as Bitcoin, have minimal transaction fees as there is no central authority.

Decentralization

Blockchain technology is decentralized; its information isn’t stored in a single location. Instead, copies of the blockchain are distributed across a network of computers. Each time a new block is added, the blockchain updates across all devices, making it difficult to tamper with the data.

Efficient Transactions

Transactions handled by central authorities can take days to settle, especially when crossing time zones. By contrast, blockchain networks operate 24/7, 365 days a year. On many blockchains, transactions can be completed in minutes, making them efficient for cross-border trades where delays are typically longer.

Private Transactions

Blockchain networks are often public databases, so anyone with internet access can view the network’s transaction history. While users can see transaction details, they cannot access specific identifying information about those making transactions. Blockchain networks like Bitcoin are pseudonymous, meaning there’s a traceable address, but the user’s identity remains concealed unless additional information is available.

Secure Transactions

When a transaction is recorded on the blockchain, its authenticity is verified by the network. After validation, the transaction is added as a block to the blockchain. Each block contains its own unique hash and the hash of the previous block, making it secure against alterations once it’s confirmed.

Transparency

Many blockchains are open-source, meaning their code is accessible to anyone. Auditors can review security, but no single authority controls or edits the code. Changes or updates require a consensus among network users, providing transparency. However, private or permissioned blockchains may limit visibility, making them suitable for organizations needing restricted access.

In the future, publicly traded companies may be required to provide financial transparency through regulator-approved blockchain reporting systems. This could prevent companies from manipulating financial statements to appear more profitable than they are.

Banking the Unbanked

Blockchain and cryptocurrency empower individuals worldwide by providing financial access regardless of gender, ethnicity, or location. According to the World Bank, an estimated 1.4 billion adults are unbanked, often living in developing regions. They store cash in hidden locations, posing risks. Blockchain wallets and cryptocurrency offer a secure alternative for such individuals, making theft more challenging.

Drawbacks of Blockchains

Technology Cost

Despite potential savings in transaction fees, blockchain technology remains costly, especially due to the computational power required. Bitcoin’s proof-of-work system, for example, consumes vast amounts of energy. Solutions like using solar power or wind farms are beginning to address these energy demands, but they’re not yet widespread.

Speed and Data Inefficiency

Bitcoin’s proof-of-work system takes about 10 minutes to add a new block, managing roughly seven transactions per second (TPS). By comparison, Visa processes up to 65,000 TPS. While blockchains like Ethereum are developing solutions to improve speed, current structures limit data storage within each block, challenging future scalability.

Illegal Activity

While blockchain’s privacy protects users’ information, it also facilitates illegal activities on certain platforms, such as the dark web, where users can engage in illicit trade using cryptocurrencies. In contrast, financial regulations require identity verification, which is not typically enforced on blockchain networks.

By operating as a decentralized record-keeping system, blockchain technology offers substantial benefits, though it faces challenges such as energy consumption, transaction speeds, and regulatory concerns.

Blockchain: Pros and Cons

This system has both advantages and disadvantages. On the one hand, it provides access to financial services for those who have previously been excluded, yet it also enables criminals to transact more easily. Many argue that the positive uses of cryptocurrency, such as offering financial inclusion, outweigh its negative applications, especially considering that most illegal activities are still carried out through untraceable cash.

Public perception of blockchain, and cryptocurrency, remains uneasy. High-profile failures of once-trusted cryptocurrency exchanges, such as Mt. Gox in 2014 or FTX in November 2022, the persistence of various crypto scams, and general wariness toward new technologies and their bold promises, all contribute to ongoing scepticism around a decentralized future. As of 2024, 44% of Americans still say they will never purchase a cryptocurrency.

Regulation

Many within the cryptocurrency space are concerned about government regulation. Several jurisdictions are introducing more stringent controls over specific cryptocurrencies and other virtual currencies. However, no regulations have been implemented that restrict blockchain usage and development, only certain products created from it.

Data Storage

A further implication of blockchain technology is the need for data storage. This might not seem substantial given the vast quantities of information already stored worldwide. However, as blockchain use grows, it will demand more storage, especially on networks where nodes hold the entire chain.

Currently, data is centralized in large data centres. If the world transitions to using blockchain across industries, the technology’s growing size will require advanced techniques to store data efficiently, or continuous storage upgrades. This could become costly, both in terms of finances and physical space. As of September 15th, 2024, the Bitcoin blockchain alone was over 600 gigabytes—and this blockchain only records Bitcoin transactions. Although small compared to the volume of data in large data centres, an increase in blockchains will add to the overall digital storage demand.

What Exactly Is a Blockchain?

In simple terms, a blockchain is a shared database or ledger. Data is saved in files, or blocks, with each network node holding a copy of the entire ledger. Security is maintained as the majority of nodes will not accept a change if an entry is edited or deleted in only one copy of the ledger.

Explaining Blockchain in Simple Terms

Imagine you type information into a document on your computer and use a program to generate a unique string of numbers and letters, called a hash. You then add this hash to the beginning of another document. When you generate another hash, it links to the previous document’s hash, creating a chain of encoded documents. Each document is stored on computers within a network. These network devices verify each document against the ones they have stored, accepting it if the hashes match. If a document doesn’t match the expected hash, it is rejected.

Blockchain for Beginners

A blockchain is a network of interconnected files linked together by programs that create hashes, or strings of letters and numbers representing file content. Each network participant, or device, verifies these hashes against its generated ones. If the hashes match, the file is retained; if not, it is rejected.

The Bottom Line

With practical applications already underway, blockchain technology is gaining attention, driven by Bitcoin and other cryptocurrencies. As a buzzword among investors, blockchain is positioned to make business and government operations more precise, efficient, secure, and affordable, with fewer intermediaries.

Entering blockchain’s third decade, it’s no longer a question of if established companies will adopt the technology but when. Today, we see NFTs and asset tokenization. In the future, a combination of blockchain, tokenization, and artificial intelligence could become integral to business and consumer solutions.

The comments, opinions, and analyses expressed here are for informational purposes only. Please read our warranty and liability disclaimer for more information.

Comments